WATAX has specialized in the multiple year's non-filers space for about 15 our of our nearly 40 year operation. Our most successful ad has been "Haven't Filed Taxes? 10 years? 3 years? Forever" which has brought a lot folks our way and we are thankful. As we headed into almost 20 years in the non-filer space, we often ponder what keeps people out of tax compliance AND what motivates people to get into tax compliance.

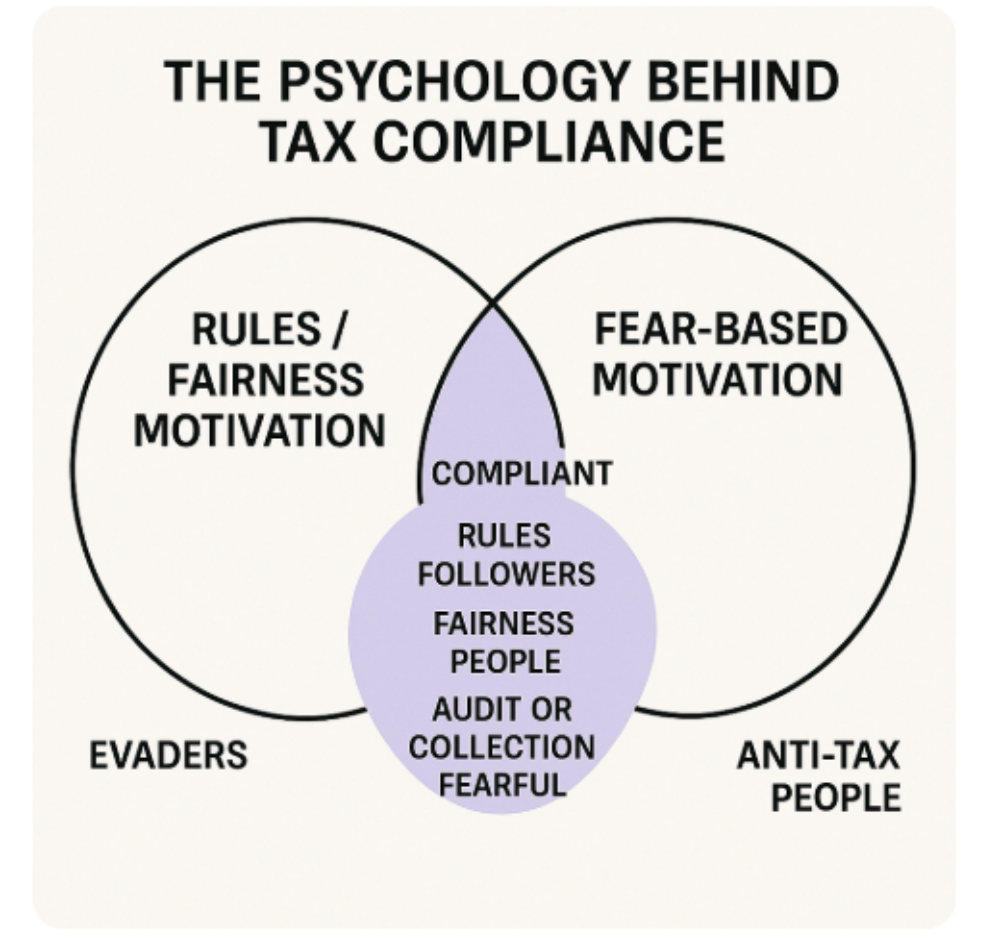

We've broken that into pretty much into two categories:

THE FEARFUL and THE RULES FOLLOWERS

- FEAR is a powerful motivator. Ultimately, most of our clients come to us out of fear of being audited, losing their passport or being affected by garnishment or levy actions.

- RULES FOLLOWERS in the non-filer space generally are procrastinators who know they have to get into income tax compliance, but keep putting it off. Many have a really good excuse like a death, divorce, birth, job loss, a major move or even a name change (!). They might sigh the biggest relief as they file their three to six years of missing returns as being out of compliance might rent more space in their head/heart than even fear will!

We also acknowledge that some people will NEVER get into tax compliance. Many of these folks don't believe the laws are fair or have a political bias against the taxing of income. Others just don't have the bandwidth to think about income taxes. All of these groups usually will get into action when a levy or passport block is pending.