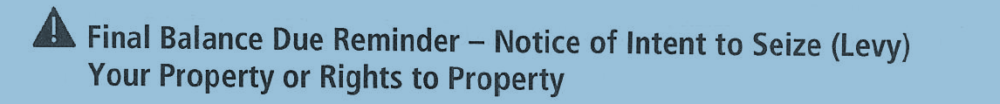

It has been a very long time - some say as long ago as early 2016 - that the IRS Automated Collection Systems (ACS) has issued levies against individuals/businesses with back tax liabilities. After this long hiatus, We have proof now that in 2024 that levies have again been going out. Knowing what letters you've received from the IRS, will help prepare yourself and prevent these levies in advance.

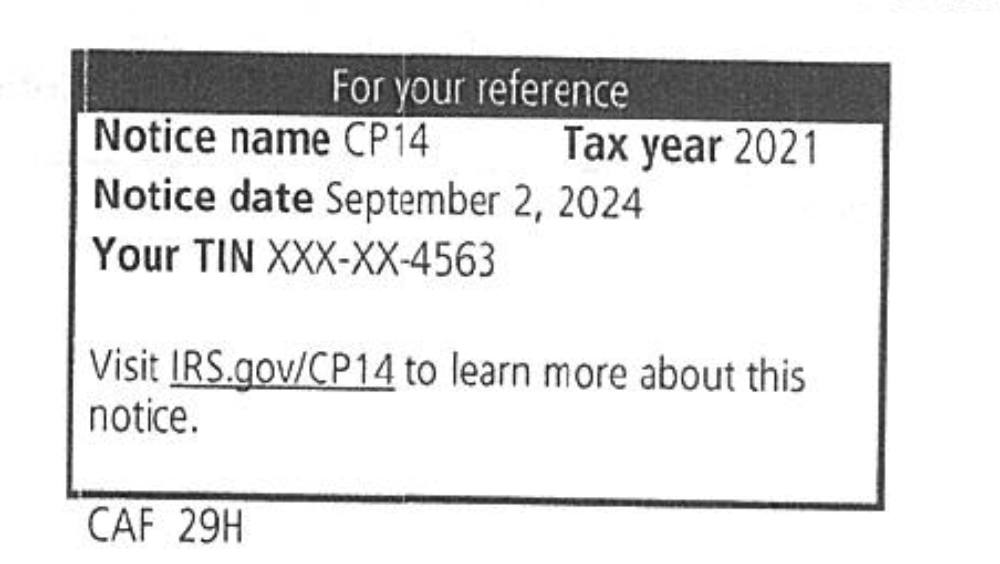

- CP14 is a generic balance due letter. Probably the earliest in the collection process. No immediate worry, but good time to touch base with your tax pros like the Staff at WATAX.

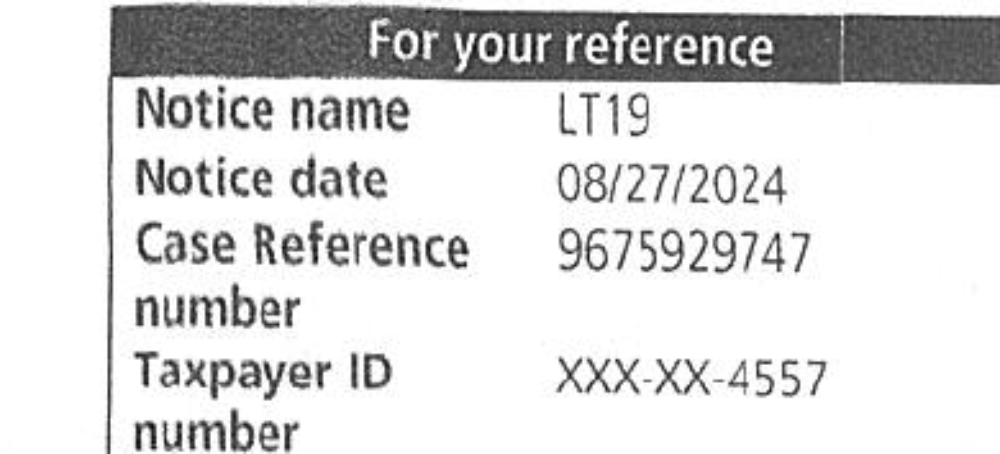

- LT19 is also a generic balance due notice that will turn into a more aggressive notice in a few months.

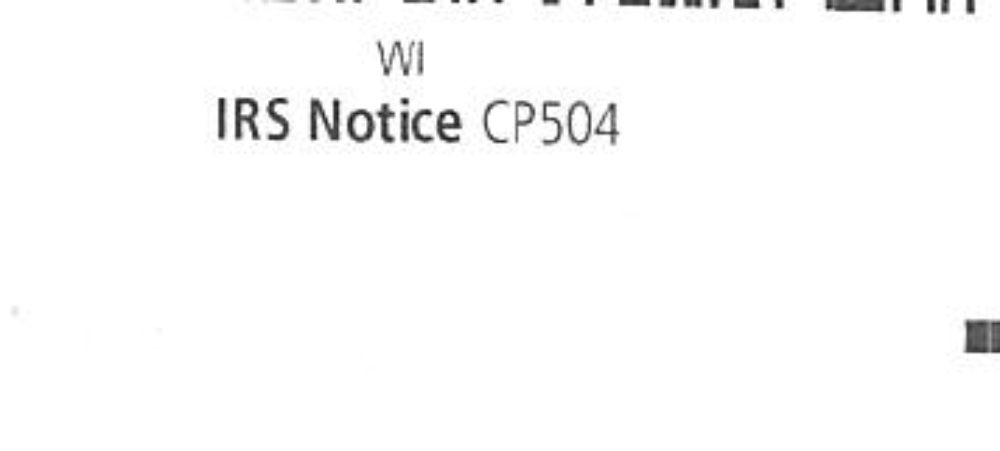

- The CP504 notice sounds much more aggressive, but in our estimation brings the case closer to levies but not the precipice.

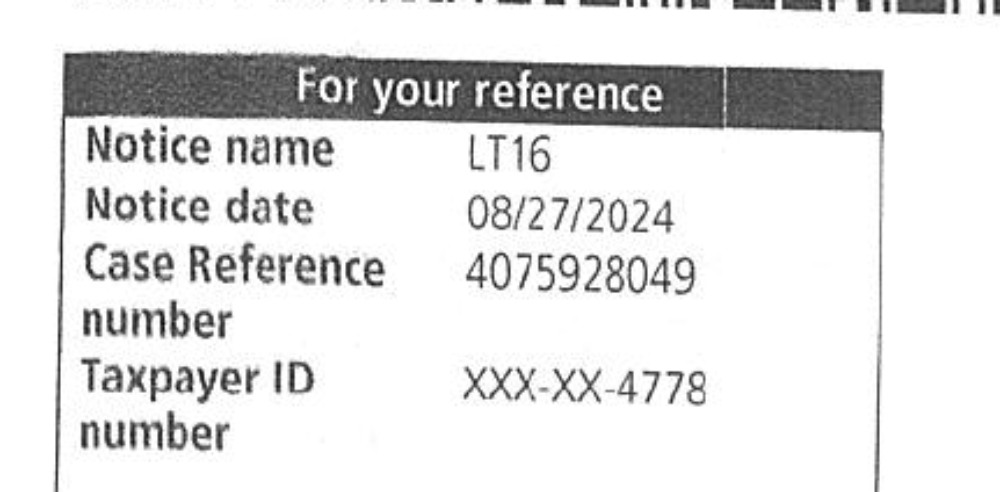

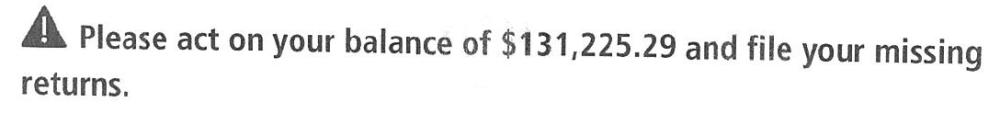

- The LT16 seems to combine unfiled returns and collections of debt into one request. This also brings the case to the edge, but not the very edge.

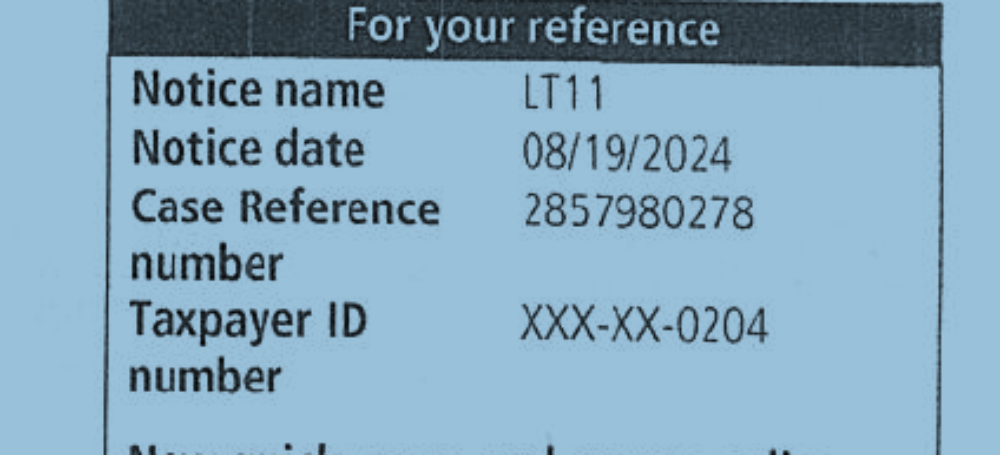

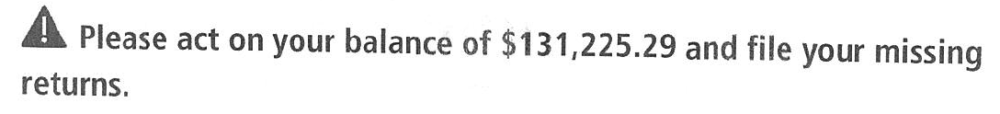

- The LT11 notice is the real deal. After receiving the LT11, you will get levied in 30 days roughly after getting this notice and not acting on it. Time to get in touch with your WATAX staff for a consultation!

Other Recommended Posts

Talk with a tax expert for free

(888) 282-4697

Registered members of the National Association of Enrolled Agents.

Registered members of the National Association of Enrolled Agents.

★★★★★

As someone who has, fortunately, little experience with legal problems, I was unsure where to turn when I received a VERY large tax assessment from the IRS. I was even more unsure about hiring a legal firm that turned up in the results of a search engine. But WATAX was the perfect choice. it took a year and a half—doesn't everything involving the IRS take forever?!—but WATAX was able to resolve my issue completely. I recommend them highly.

E. Schaltenbrand

Via

Is 2026 the year to solve your tax issue? WATAX is ready to assist you now. Please call us at 1-888-282-4697 or email us a description of your tax issue and we'll contact you promptly.