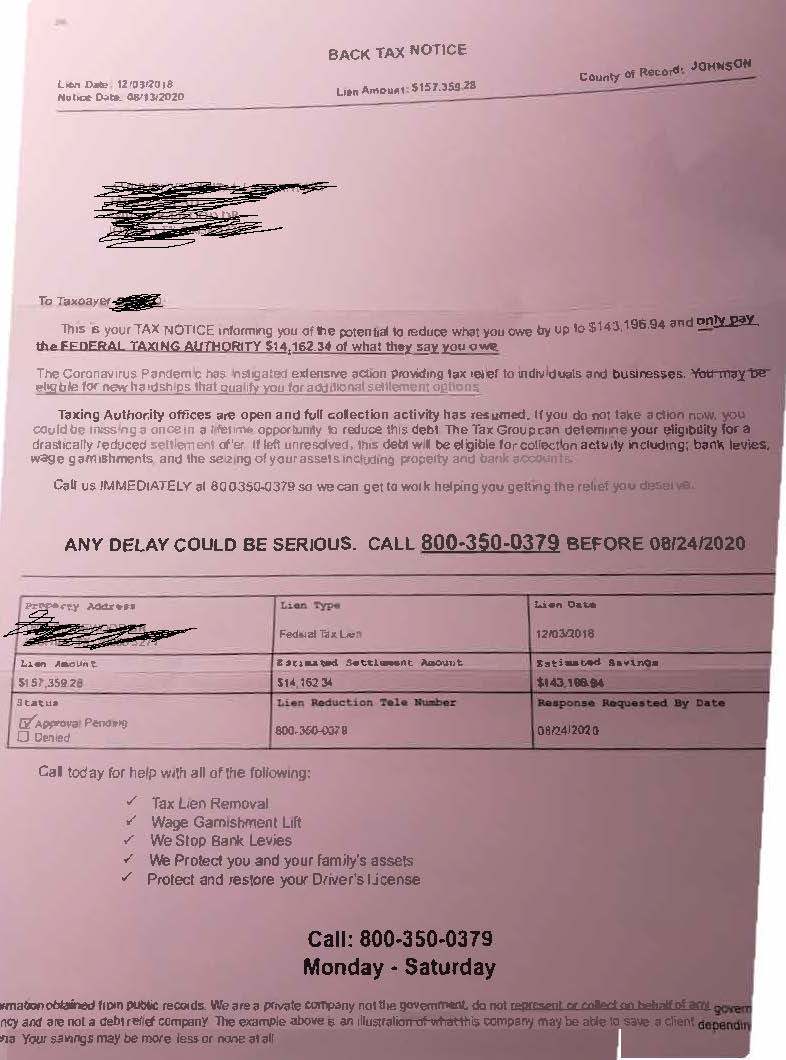

So, one of the oldest forms of marketing in tax resolution is to send letters to people/businesses who have Tax Liens. In fact, WATAX sent out mailers from 1989 to 2011 and it was effective marketing. The key is can you do it while representing tax resolution options honestly? We certainly tried. The above letter claims there is "new tax relief" due to Coronavirus which isn't exactly true in the "settlement" area, (but the IRS is generally laying off super aggressive collections.) The "Estimated Settlement Amount" is really arbitrary. In fact, settlements can go much less than the 10% they estimated here and, on the other hand sometimes aren't possible at all.

The client who sent us this letter was already in an installment agreement and didn't qualify for a settlement - but he wondered if he did. Some credit to Tax Group who sent the letter: it isn't nearly as bad as the one we wrote about in June which pretended to be a government agency. The fact of the matters some people qualify for settlements, others do not. We estimated about 37% of our customers qualified for an Offer in Compromise or settlement.