As we have been reporting throughout 2025 with no signs of stopping in 2026, the IRS is levying more than ever. We wanted to show you actual balances of two recent clients who were levied by Automated Collection Systems(ACS).

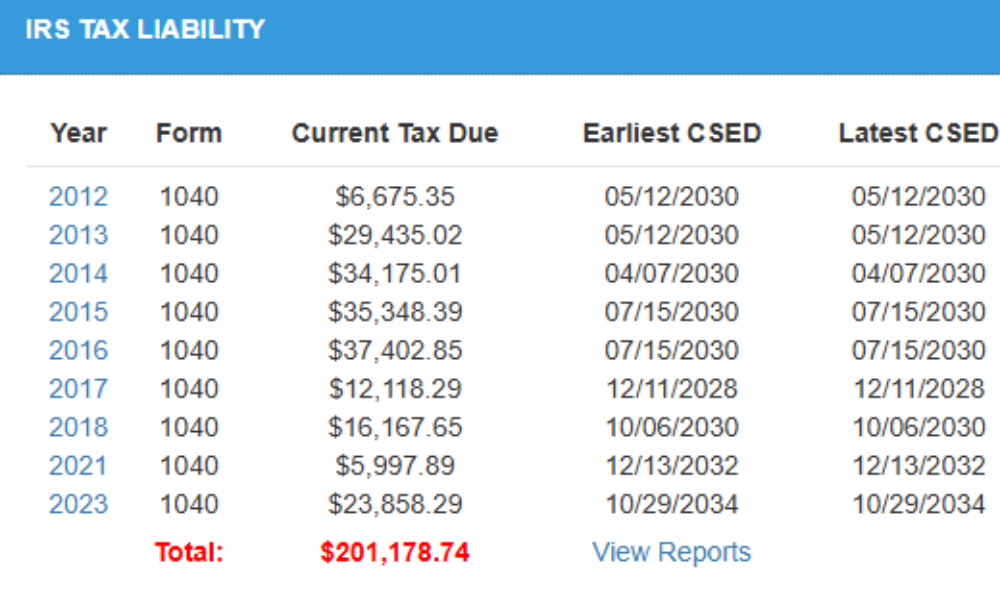

This first client's balance that of a self-employed realtor, had a significant levy. His case is instructive: get into an installment agreement, propose an Offer in Compromise or hardship status as soon as you receive an IRS LT-11 letter, as we were unable to release his bank levy which held $50,000.

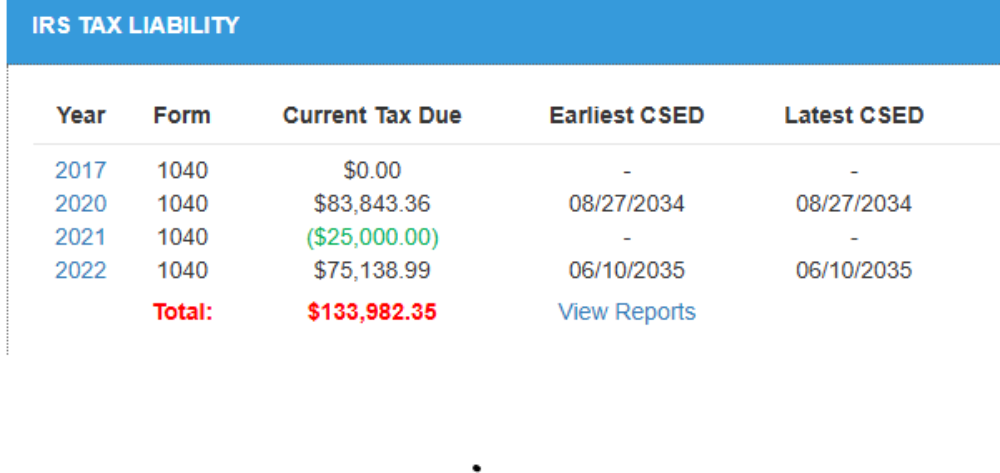

This second client, who runs a healthcare service, also had a significant amount of money held and paid to the IRS, at least $25,000. We also were unable to release the levy showing the need to act on LT-11 letters before you get garnished. Had her case been assigned to a local IRS officer our chances of levy release were much higher. The Trump 2.0 IRS is very strict about levies particularly when issued by the understaffed IRS-ACS. Most levies are bank levies. We are not seeing wage garnishments very often.