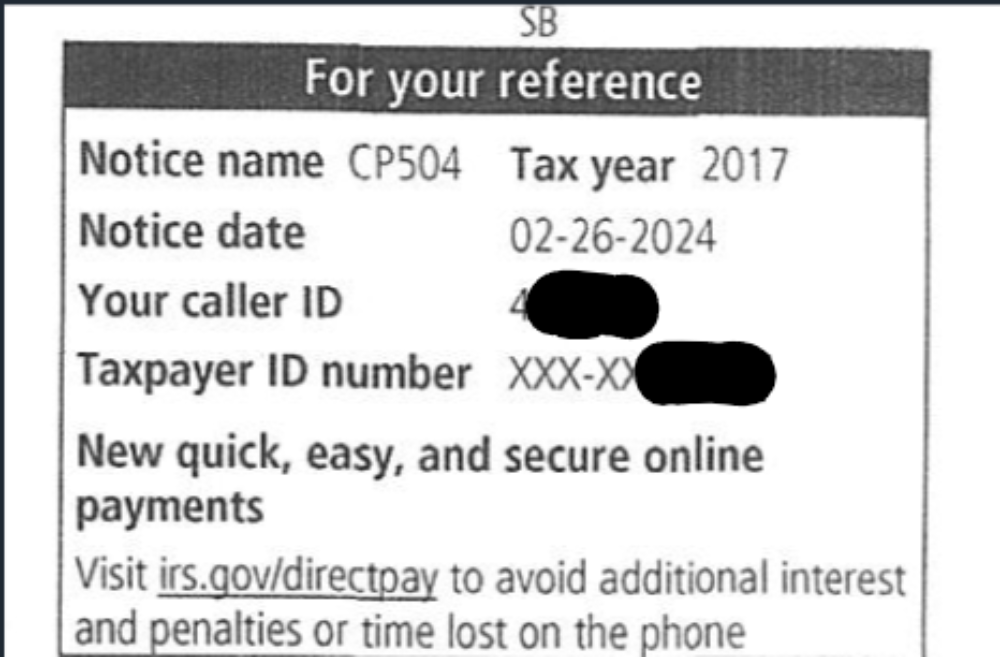

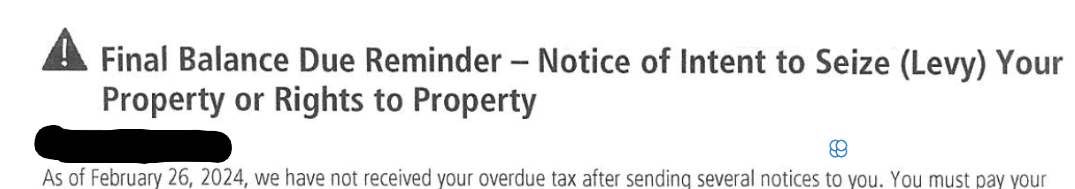

In early 2024, it is clear that the IRS has accelerated collection activity. Aggressive IRS letters are being issued like the ones pictured here. Multiple year non-filers, particularly higher income people, are being targeted by IRS Officers to get into compliance. Revenue Officers continue to levy individuals and businesses that blow them off. But if you are getting Cp504 letters, will they follow thru with levies or garnishments?

Cp504 letters, historically, have been the final letter individuals would get before Automated Collection Systems (ACS) would issue wage or bank levies.

But in our analysis/close view, the verdict is still out - whether ACS will actually follow thru on levies? Since 2016, they have been sporadic at enforcing the levies.

Either way, how can you avoid or manage this risk?

Definitely contact your representative at WATAX. Let our professionals review your transcripts thru our proprietary software: find out when your debts expire, see if there are any easily waivable penalties, determine if an Offer in Compromise is a good route or work out a livable agreement to lower the chance of levies.

Is 2026 the year to solve your tax issue? WATAX is ready to assist you now. Please call us at 1-888-282-4697 or email us a description of your tax issue and we'll contact you promptly.