In our 35 year history, WATAX dedicates ourselves to giving our client's the most cutting edge institutional knowledge on how to resolve tax problems. Included in our customer service minded approach is investing in the best software for tax resolution and multiple year non-filer clients.

When a client hires WATAX, we post IRS Power of Attorney and get full access to their transcripts and are able to monitor the progress of their case ongoingly.

Here's some of the features of having WATAX representation and our elite software access:

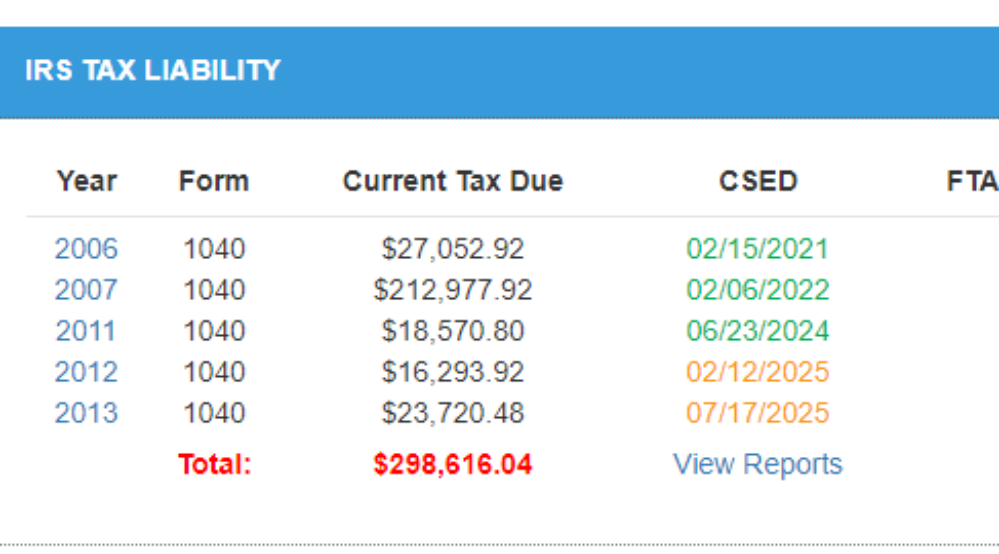

Balance due updates with CSEDS (expiration dates) When is your tax liability going to expire? How much do you owe now?

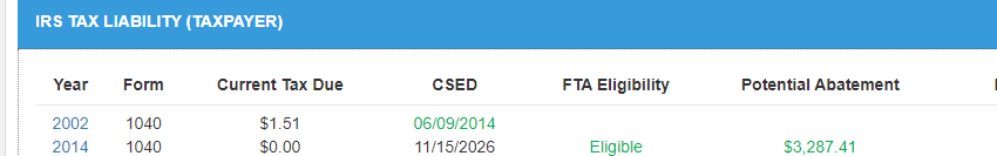

First time abatement - Identifying penalties we can get REFUNDED to clients or removed from their balances.

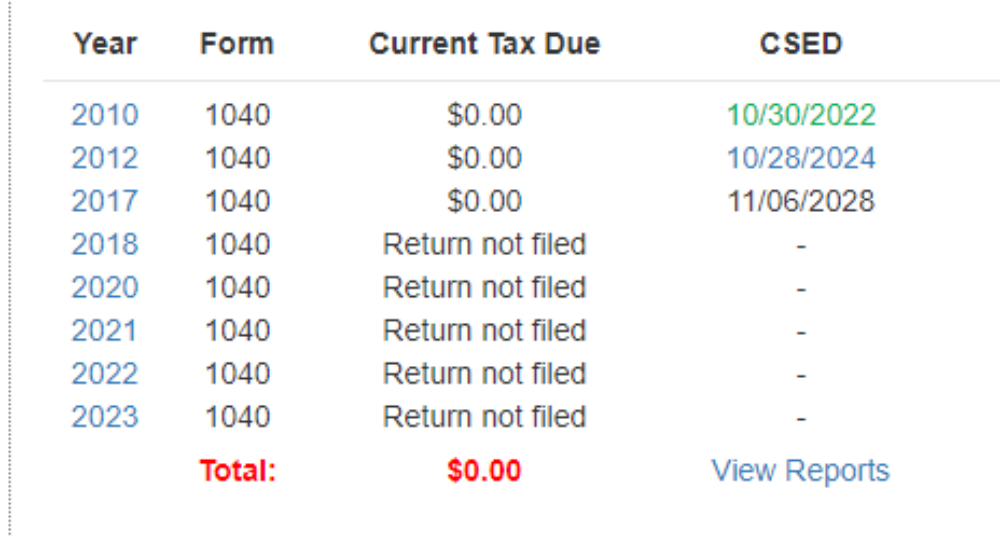

Identifying unfiled years - When is the last year you filed a return? What returns should be done?

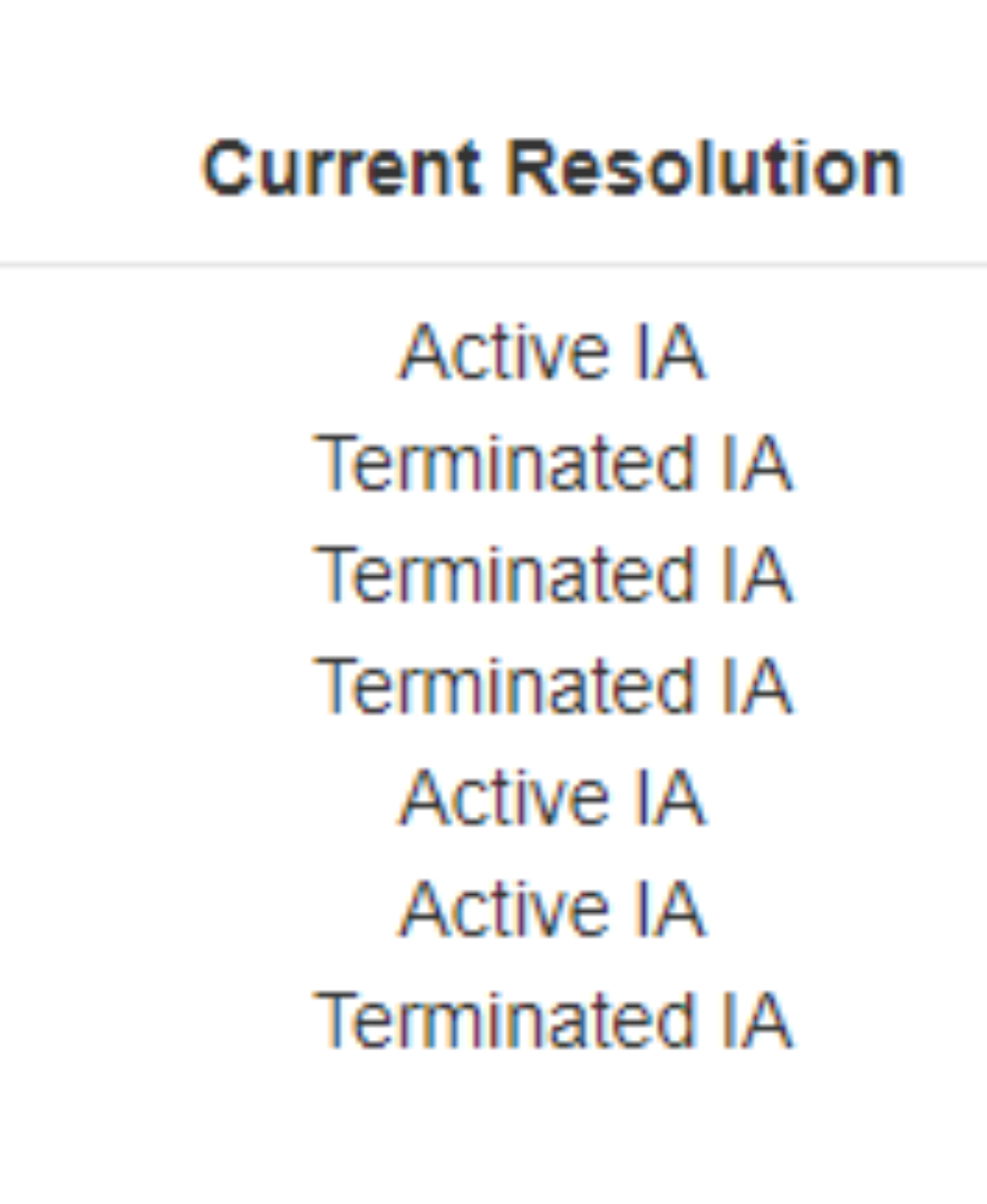

Defaulted agreement or IA - Did you miss a payment? Are you back in collections?

WATAX is dedicated to getting our clients back into full IRS compliance. Our elite research is the first step in providing this service.

Is 2026 the year to solve your tax issue? WATAX is ready to assist you now. Please call us at 1-888-282-4697 or email us a description of your tax issue and we'll contact you promptly.