If you have been out of 1040 tax compliance for a few years, you will eventually get scrutiny from the IRS. One of the most common interventions is for them to lock your W4 at your employer. This is not a wage garnishment as the IRS is not collecting back taxes. But rather, the W4-lock forces you to withhold more at your job than you are currently are doing so you don't owe again. Sometimes their calculation is correct - often it is wrong - and is done perhaps just to get your attention.

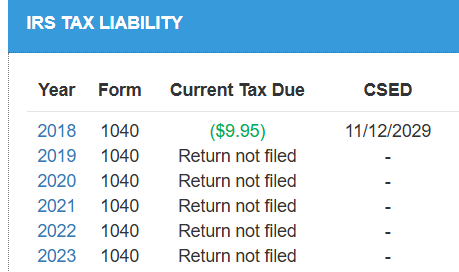

Here is the exact record of a client who recently received a W4-lock. As you can see the person just wasn't current on their taxes:

How can you get the W4 lock reversed or back to a fair amount of withholding?

First, get into compliance by filing the missing returns. Second, try your best to pay the most recent tax year in full including penalties & interest. Finally, you'll need to get your fax # for your employer. You or your licensed tax pro at WATAX will then contact the IRS division that handles W4 problems, provide the most recent tax return with proof of payment, and get the W4 reversed to a reasonable amount.